Overview

The 2023 Ontario Financial Returns (FIR) report is being updated to collect ARO information. Changes have been made to the 2023 and later FIR reports in Citywide (i.e., Financial Returns Report) to reflect these changes. Please review the information below for an explanation of the changes to each schedule.

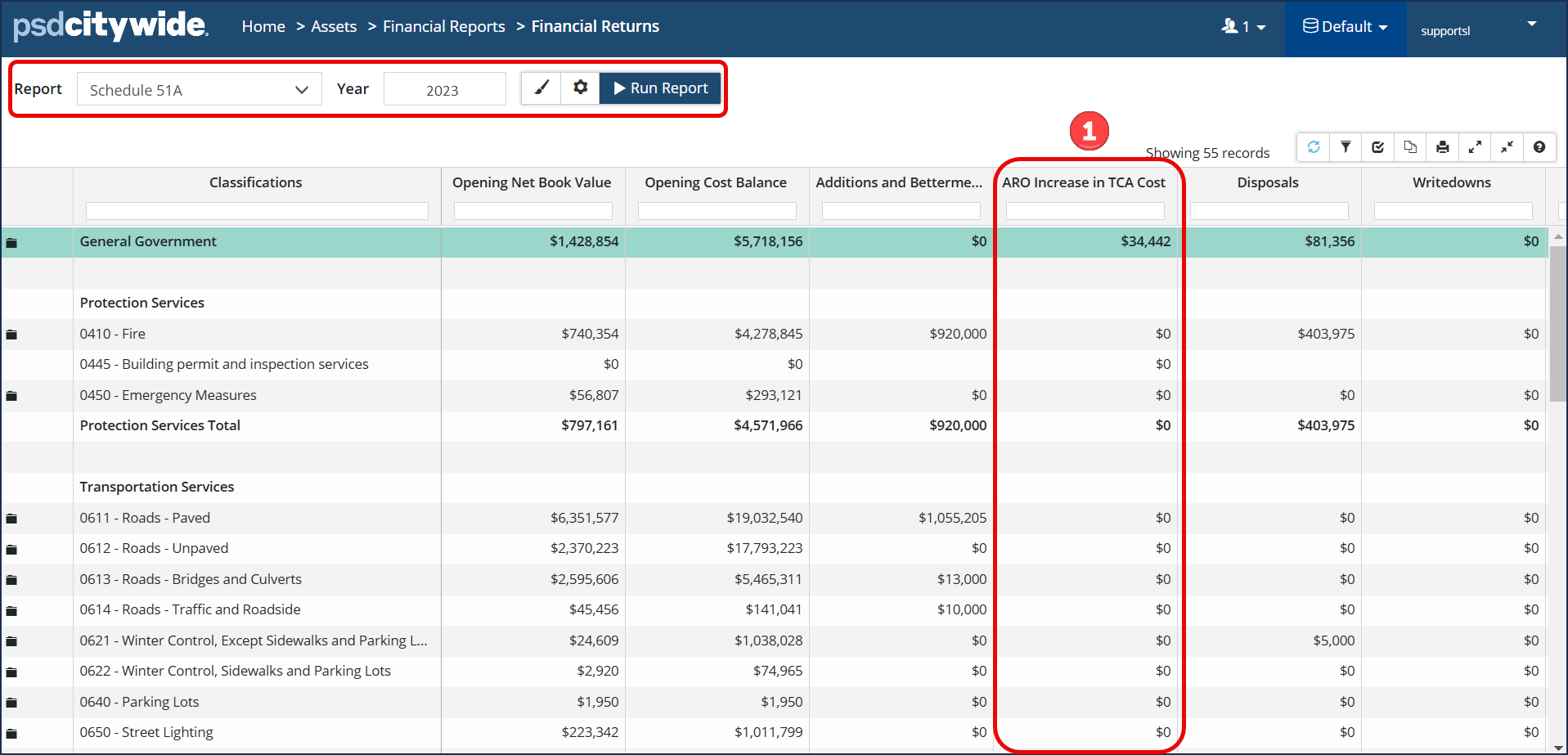

Schedule 51A has been updated to include the combined asset + ARO amortization numbers for 2023 onward. Any assets with an ARO disposal will still be included in the report.

Changes to Schedule 51A in Citywide for 2023 onwards include:

- New column to reflect ARO new acquisition costs (ARO Increase in TCA Cost) .

- Existing columns updated to asset + ARO combined totals.

- Opening/Closing Net Book Value includes asset plus ARO net book values.

- Opening/Closing Balance includes asset plus ARO cost balances.

- Additions and betterments includes asset additions, asset new acquisitions, and ARO additions.

- Disposals includes asset cost disposals and ARO cost disposals.

- Writedowns includes asset writedowns and ARC writedowns.

- Opening/Closing Amortization Balance includes asset plus ARO accumulated amortization values.

- Annual Amortization includes asset plus ARO amortization expenses.

- Amortization Disposal includes asset plus ARO accumulated amortization disposals.

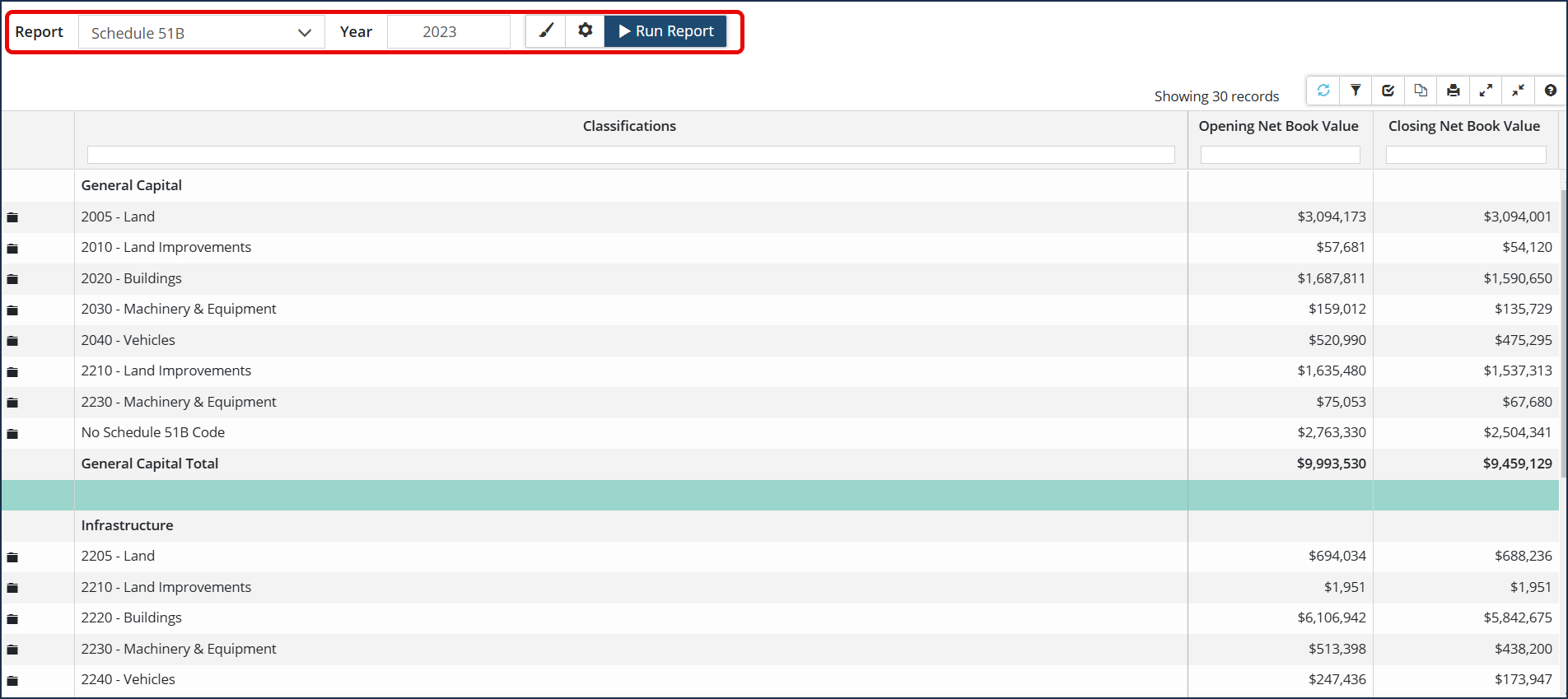

Schedule 51B has been updated to include the combined asset + ARO net book values for 2023 onward.

The 2023 FIR report combines schedules 51B and 51C into one report. Due to format and reporting in Citywide (and since the column headings are different for the construction-in-progress section) we have kept the schedules separate.

To generate 51B for 2023 FIR, you will need to run both 51B schedules and copy/paste into the appropriate sections of the new 51B schedule.

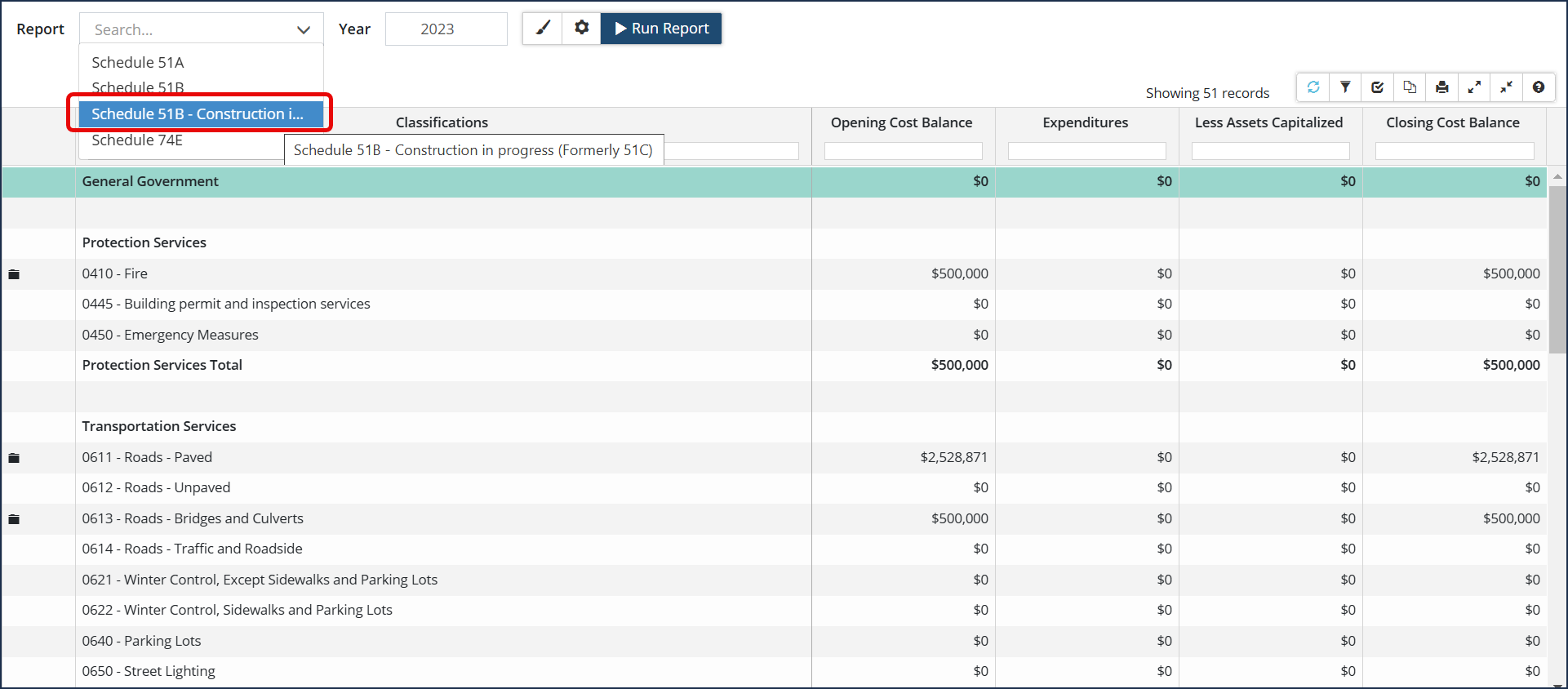

Schedule 51B - Construction in progress (Formerly 51C)

Schedule 51B has been renamed to Schedule 51B - Construction in progress (Formerly 51C) to reflect the changes in the 2023 FIR report. Schedule 51C is removed from FIR 2023 onwards, and the information for Construction-in-progress assets is now being pulled into Schedule 51B - Construction in progress.

Schedule 74E is a new report in Citywide that captures the asset retirement obligation liability details needed for the 2023 FIR.

The Schedule 74E report will not run for 2022 or earlier. Based on the reporting requirements and instructions of the FIR, the 2023 74E will have a different set of rules than 2024 and later. Some differences include:

- The 2023 FIR will have all pre-existing assets with AROs being reported in the Liabilities for ARO at Beginning of Year column.

- In 2024 onwards, Liabilities for ARO at Beginning of Year will be equal to the ARO accretion opening balance.

- The 2023 FIR will only display a value in Liability Incurred During the Year if the asset has an in-service-date of 2023, and an ARO effective date of 2023 (or blank), and has an ARO cost estimate.

- In 2024 onwards, any new assets with AROs (or old assets with newly added AROs) will be reported as a Liability Incurred During the Year.

Some details required in 74E are not calculated in Citywide, and so may need some manual input in the FIR. These include:

- Column 2: Transfer of Solid Waste Landfill Liability

- Column 6: Increase (Decrease) Reflecting Change in the Estimate Liability